Asset Management and Property Management are often times confusing to distinguish between the two. Let us explain how Capital Rivers defines the difference between Asset and Property Management and the impacts they have on your investment throughout California. In the simplest form, Property Management is the management of the physical asset and should be the first point of contact for tenants and vendors. Asset Management encompasses the financial and economic values of the asset. An Asset Manager should focus on strategically improving the financial performance and investor objectives of a real estate asset through its life cycle.

Asset Management is management of an investment.

Asset management is the proactive management of a real estate investment, with the primary goal of maximizing its financial return.

It involves more than just overseeing the property; it’s about strategically enhancing the asset’s value over time. This could include making decisions around renovations, refinancing, or even the timing of a sale to optimize returns.

An asset manager focuses on improving the financial performance of the property by analyzing market trends, evaluating risk factors, and ensuring that the property aligns with the overall investment strategy.

By looking at both short-term and long-term goals, they work to meet investor objectives, such as increasing cash flow, enhancing property appreciation, and improving profitability.

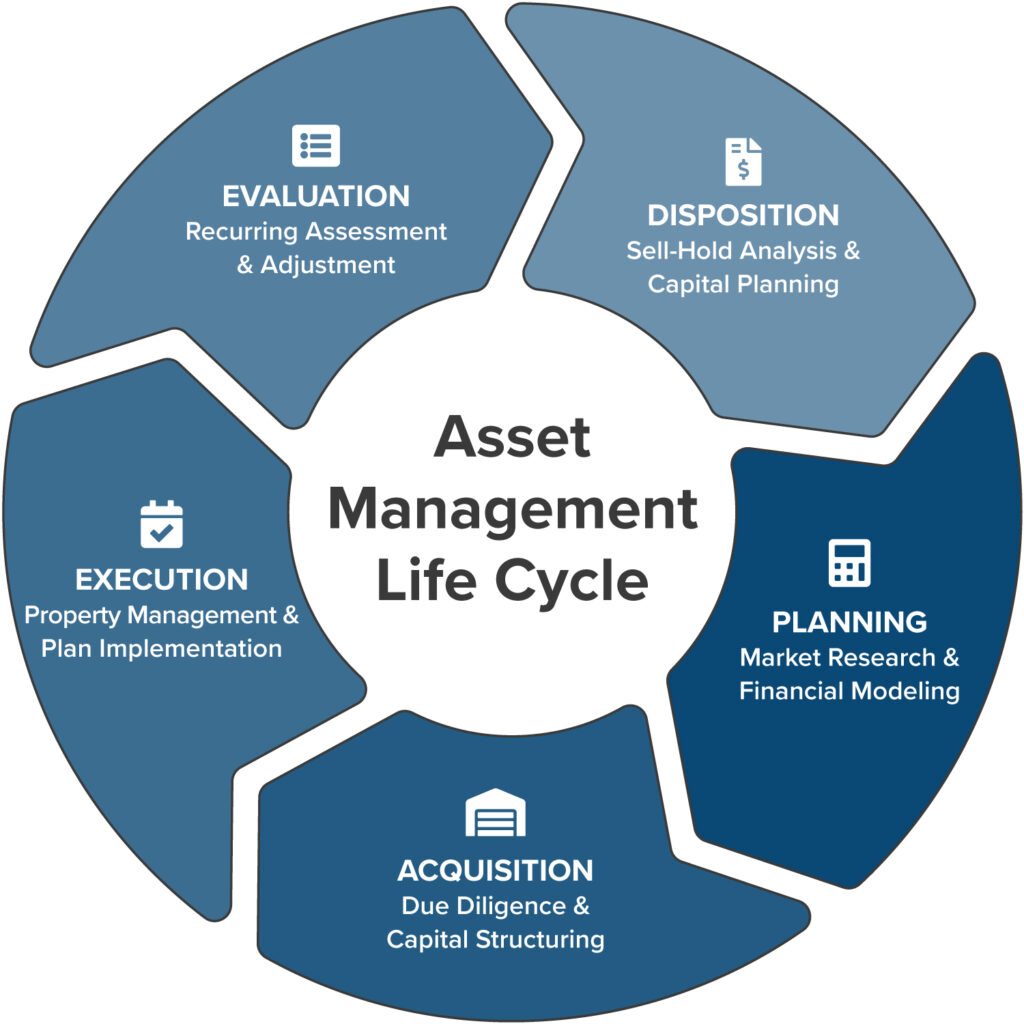

Asset management is a continuous process that spans the entire life cycle of a property, ensuring that it remains a valuable part of the investor’s portfolio.

A focus on strategically improving the financial performance and investor objectives of a real estate asset through its life cycle.

Property Management is the management of a physical asset.

The primary point of contact for tenants, as well as the party responsible for preliminary budgeting, accounts receivables, accounts payables, obtaining competitive pricing from vendors and overseeing onsite personnel.

In summary, the distinctions between Asset Management and Property Management lie in their respective domains within real estate investment. Property Management deals with the physical asset and serves as the primary contact for tenants and vendors, handling basic budgeting and onsite personnel oversight.

Conversely, Asset Management navigates the financial trajectory of the asset, aiming to enhance its financial performance and align with investor objectives throughout its life cycle. The synergistic coordination of both realms is crucial for augmenting the financial viability and operational smoothness of the real estate asset, thereby fostering a well-managed and profitable investment portfolio.

Asset Management vs. Property Management: Key Differences Explained

While both asset management and property management play vital roles in real estate, their focus areas are distinct. Property management is primarily concerned with the day-to-day operations of the physical property. This includes tenant relations, maintenance, rent collection, and ensuring that the property is functioning smoothly.

On the other hand, asset management takes a broader, financial perspective. An asset manager focuses on the overall investment strategy, aiming to maximize the financial performance of the property over time. This involves making decisions related to buying, selling, or improving the property to align with the investor’s long-term goals.

In essence, property management ensures the property is running efficiently, while asset management ensures it remains a valuable and profitable investment.

To learn more about how we can assist with your real estate projects, explore our services in Commercial Real Estate Development. Our expert team offers comprehensive solutions for all stages of development, ensuring your investment thrives.

Why Both Asset Management and Property Management Are Essential for Real Estate Success?

Asset management and property management are two complementary components that work together to ensure the overall success of a real estate investment. While property management handles the day-to-day operations—such as tenant relations, maintenance, and rent collection—asset management focuses on the broader financial strategy of the investment.

Property management is crucial for ensuring that the physical asset is well-maintained and that tenants are satisfied. A well-managed property not only retains its value but also attracts and retains quality tenants, which is essential for generating consistent rental income.

On the other hand, asset management is vital for enhancing the long-term financial performance of the property. By making strategic decisions about capital improvements, market positioning, and refinancing, an asset manager ensures that the property remains a profitable investment throughout its life cycle.

Together, both roles are essential: property management keeps the asset running smoothly in the present, while asset management secures its future profitability. This combined approach ensures that investors can maximize both operational efficiency and financial returns, leading to overall real estate success.

For more information about how we can support your real estate needs, visit Our Company services page. At Capital Rivers, we provide a wide range of solutions designed to help you succeed in the real estate market.

Learn more about Capital Rivers Property Management Services