As we reach the midpoint of 2022, the commercial real estate sector faces a period of unprecedented challenges and uncertainties, arguably the most significant in recent history. This Mid-Year Commercial Real Estate Market Update brings forth a candid assessment from Greg Aguirre, President & CEO of Capital Rivers Commercial, who shares his insights and advice for navigating the volatile second half of the year.

Reflecting on Past Challenges and the Current State of the Market

The commercial real estate industry has weathered various storms, including the double-digit interest rates of the early 1980s and the Savings and Loan crisis a decade later. However, the current climate presents a unique set of challenges. Aguirre, with his extensive experience, provides a perspective that balances seasoned wisdom with a recognition of the novel circumstances the market currently faces.

Greg Aguirre’s Perspective: A Developer at a Tipping Point

In his mid-year update, Aguirre emphasizes that the commercial real estate sector is at a critical tipping point. Developers are finding themselves in a tight spot, with narrowing margins making projects either financially unfeasible or excessively risky. This challenging situation is compounded by recent hikes in interest rates and construction costs reaching all-time highs. According to Aguirre, these factors have led several developers to either halt their projects or abandon them entirely, as the current economic conditions render these ventures less viable.

The Impact of Economic Shifts on Commercial Real Estate

This Mid-Year Commercial Real Estate Market Update highlights the impacts of broader economic shifts on the sector. The spike in interest rates and soaring construction costs are not just numbers; they directly influence decision-making processes, investment strategies, and the overall health of the commercial real estate market. As a result, the industry is experiencing a period of recalibration, where both risks and opportunities must be carefully weighed.

Looking Ahead: Preparing for a Volatile Second Half

As we move into the second half of 2022, Aguirre’s advice is invaluable for stakeholders within the commercial real estate sector. His insights, grounded in both expertise and instinct, suggest a cautious yet strategic approach to navigating these uncertain times. Stakeholders are encouraged to stay informed, remain flexible, and prepare for potential volatility in the market.

Conclusion: A Time for Careful Strategy and Resilience

This Mid-Year Commercial Real Estate Market Update serves as a crucial checkpoint for industry professionals, investors, and analysts. It reminds us that while the current landscape is challenging, it also presents an opportunity to adapt, innovate, and demonstrate resilience. As the year progresses, the commercial real estate sector will continue to evolve, influenced by economic trends and the strategic decisions of its key players.

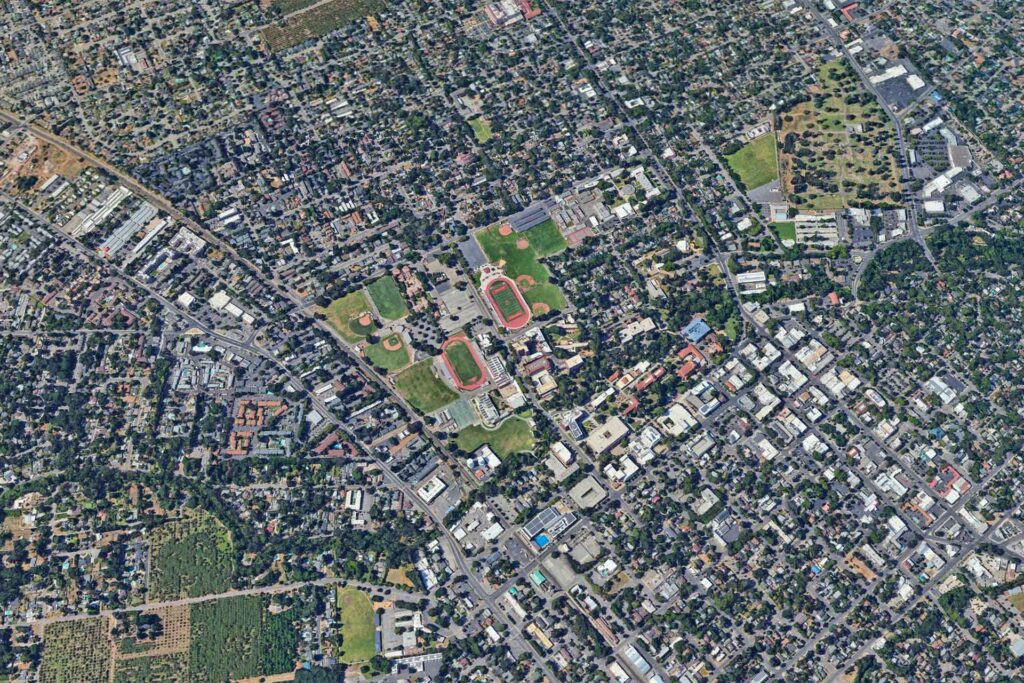

Listen to our mid-year commercial real estate market update or you can download our recent Sacramento Commercial Real Estate Market Reports.