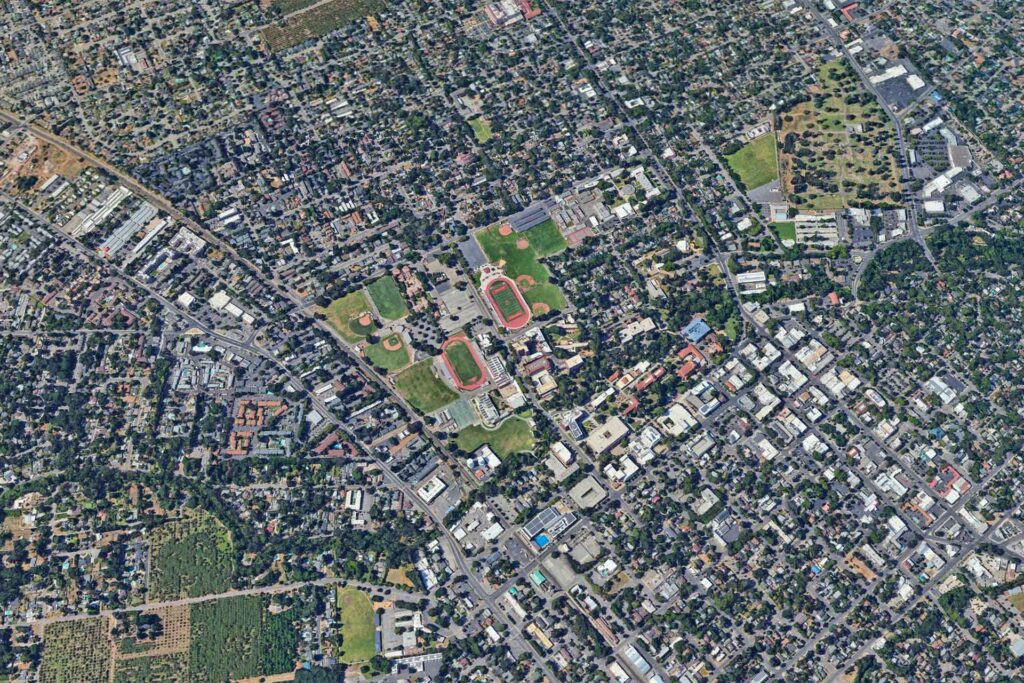

Welcome to the Capital Rivers Connect – California Edition podcast!

Our latest California Commercial Real Estate Market Update dives into the state’s performance in 2023 and unveils a cautiously optimistic forecast for 2024, drawing insights from our conversation with Greg Aguirre, CEO of Capital Rivers.

Let’s face it, 2023 was a challenging year in the commercial real estate market. With the failure of Silicon Valley Bank, rapidly rising interest rates, and a slowing economy, it was an adventure. The good news is the market has adjusted to the new norm, and it’s truly a professionals market- where deals that make sense and pencil are getting done, and those based on speculation don’t. In this download, Greg Aguirre joins us to offer an optimistic, yet realistic forecast on where he sees opportunity, and challenges, in the year ahead.

Navigating 2023’s Challenges:

2023 saw the California commercial real estate market grapple with various obstacles, including:

- Rising interest rates: This significant factor dampened investor enthusiasm and slowed down deal flow.

- Supply chain disruptions: The disrupted supply chain caused delays and inflated construction costs, impacting project timelines and budgets.

- Increased construction costs: Rising material and labor costs further challenged developers and investors.

Looking Ahead to 2024: Cautious Optimism

Despite the headwinds of 2023, Greg Aguirre remains cautiously optimistic about the year ahead, predicting:

- Resurgence of investor activity: As interest rates stabilize, investors who previously remained on the sidelines are expected to re-enter the market, seeking opportunities.

- Shift towards fundamentals: With increased competition, developers and investors will likely prioritize sound real estate fundamentals like risk management and long-term value creation.

- Sector-specific strength: While the overall market adjusts, specific sectors are expected to experience continued performance:

- Retail: Particularly A-class and lifestyle centers are anticipated to show resilience.

- Industrial: Fueled by growing demand from industries like biotech, the industrial sector is expected to remain robust.

- Multifamily: Despite potential headwinds, the multifamily sector is projected to hold steady.

Beyond the Headlines:

Our California Commercial Real Estate Market Update also explored:

- The long-term viability of brick-and-mortar retail in the age of e-commerce.

- The impact of escalating insurance costs on multifamily asset valuations.

- The challenges facing the hotel sector due to rising competition and economic uncertainty.

Greg emphasizes the importance of being adaptable and focusing on strong fundamentals for success in this evolving market landscape.

Capital Rivers is constantly staying up to date with commercial real estate news. To learn more about this and future updates from Capital Rivers Commercial, Subscribe To Our Newsletter!

Thank you for downloading and listening to the Capital Rivers Connect – California Edition podcast. If you’re interested in partnering with us, visit Capital Rivers to learn more and follow us on LinkedIn, Facebook and Instagram for the latest real estate opportunities.