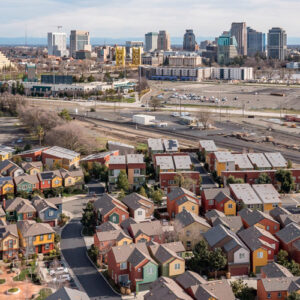

Investing in commercial real estate has long been a proven wealth-building strategy, but the market’s shifting dynamics add complexity to decision-making. In Sacramento, factors such as recent interest rate cuts, growing demand for housing, inflation, and consumer confidence are all shaping the real estate landscape. So, is Sacramento’s commercial real estate market a good investment right now? This article explores key drivers and provides a sector-by-sector analysis, including the growing life-science and biotech sectors, to help you make an informed decision.

Competing in Sacramento’s Dynamic Commercial Property Market

Competing in Sacramento’s Dynamic Commercial Property Market

Sacramento’s commercial real estate market is highly competitive, with strong demand across a range of property types. However, as the market matures, investors are finding fewer opportunities for high returns. Large institutional firms and well-capitalized investors often accept lower returns or take on higher risks, banking on continued growth. This dynamic makes it tougher for smaller or more opportunistic investors to compete for properties, where high pricing and compressed cap rates are common.

A factor contributing to this activity is the 1031 exchange rule, allowing property owners to defer capital gains taxes by reinvesting in other properties. This rule can create urgency for some sellers, pushing them to close deals and reinvest quickly. However, broader economic factors—such as tighter lender requirements, fluctuating interest rates, and inflation—also play a significant role in determining long-term returns and should be carefully considered by investors.

Interest Rates and Financing in Sacramento’s Commercial Real Estate Market

A recent interest rate cut has had an impact on Sacramento’s real estate market. After a period of rising rates that increased borrowing costs, the Federal Reserve’s rate cut has lowered financing costs for investors, making it easier for those leveraging capital to close deals and improve their return on investment.

The reduction in borrowing costs has renewed interest in commercial real estate, particularly among those who had delayed transactions waiting for better financing conditions. However, even with cheaper borrowing options, lender requirements have tightened. Banks are becoming more conservative, requiring larger equity contributions upfront, which can pose challenges for some investors.

Although financing has become more favorable, developers still face obstacles like high construction costs and labor shortages. Materials remain expensive due to ongoing supply chain disruptions, and labor is hard to secure, slowing project timelines. These factors lead to tight margins, making many new development projects riskier, with some developers halting projects that no longer seem viable.

Sector-Specific Analysis: Key Trends in Sacramento’s Commercial Real Estate Market

Sector-Specific Analysis: Key Trends in Sacramento’s Commercial Real Estate Market

Sacramento’s commercial real estate market is diverse, with various property types experiencing different levels of demand and growth. Below is an analysis of the key sectors: multifamily, office, industrial, retail, land, and the emerging life-science and biotech industries.

1. Multifamily Real Estate

Sacramento’s multifamily housing market continues to thrive, largely due to a shortage of affordable housing and the increasing difficulty of homeownership caused by elevated mortgage rates. As more people opt to rent for longer periods, vacancy rates remain low, and rental demand stays high. However, inflation and the rising cost of living may limit the extent to which rents can continue to rise, with more renters potentially seeking older, more affordable apartments.

For investors, the multifamily sector offers stable returns, especially with affordable housing in such high demand. However, as the pace of new development slows due to high construction costs, redevelopment projects aimed at modernizing existing properties may become more attractive.

2. Office Real Estate

The office sector in Sacramento faces challenges as businesses adjust to hybrid work models, reducing their need for large traditional office spaces. While there has been some recovery in office leasing, the demand for conventional office space has dropped. Many companies are downsizing and seeking smaller, more flexible office environments that cater to remote or hybrid workforces.

As companies reassess their office space needs, many are opting for smaller footprints, which puts pressure on older, large office buildings. Additionally, rising operational costs and labor challenges are forcing companies to think creatively about optimizing office space. The future of the office market in Sacramento will depend on how businesses adapt to hybrid work and how quickly they modify their space requirements to meet employee needs.

3. Industrial Real Estate

Sacramento’s industrial real estate market is one of the most robust sectors, driven by the continued growth of e-commerce and the increasing demand for logistics and warehousing facilities. The industrial sector has benefited from Sacramento’s strategic location, offering easy access to major transportation hubs, which supports the growing demand for efficient supply chain operations.

Although the industrial market is expected to remain strong, inflation and shifts in consumer spending could slow the sector’s rapid growth. As companies focus on maximizing efficiencies in their existing spaces, they may slow expansion plans, which could moderate rent increases in the future. However, industrial real estate in Sacramento is still expected to remain resilient given its essential role in logistics and distribution.

4. Retail Real Estate

Retail real estate in Sacramento presents a mixed outlook. Essential retail businesses—such as grocery stores, discount retailers, and fast-food chains—continue to perform well, as consumers prioritize necessities. However, non-essential retail properties face greater uncertainty, especially if they have not adapted to a changing retail landscape that emphasizes e-commerce and omni-channel experiences.

For investors, retail properties that cater to essential consumer needs are likely to remain stable, as these businesses tend to perform well in both strong and weak economic environments. Conversely, retail sectors dependent on discretionary spending may experience more volatility, particularly as inflation impacts consumer behavior and spending power. Focusing on essential retail and businesses that have a strong e-commerce presence may offer more stability in this shifting market.

Strategic Commercial Real Estate Development can significantly enhance property value and attract the right tenants, making it a smart choice for long-term investors.

5. Land

The land sector in Sacramento has become increasingly attractive as developable space becomes scarcer in the region. Investors and developers are looking at land acquisitions as an opportunity to build new residential communities, industrial facilities, or mixed-use developments. However, rising construction costs, labor shortages, and stringent lender requirements make land development more complex and risky.

Despite these challenges, land investments offer long-term growth potential, especially in high-demand areas zoned for multifamily or industrial use. The growing demand for housing and logistics infrastructure has made land a valuable asset for developers looking to expand Sacramento’s urban footprint. Land banking—where investors purchase and hold land for future development or resale—has become a popular strategy as prime development sites become harder to find.

For investors, acquiring land for future development or holding it for potential appreciation offers a viable strategy, though it requires careful consideration of location, zoning restrictions, and regulatory hurdles.

6. Life-Science and Biotech Real Estate

Sacramento is emerging as a hub for life-science and biotech industries, with demand for specialized real estate in these sectors on the rise. The region’s proximity to research institutions, such as the University of California, Davis, and its strong talent pool make it an attractive destination for biotech companies looking for space to grow.

Life-science real estate includes highly specialized facilities like laboratories, research centers, and manufacturing spaces for biotech firms. These properties require specific infrastructure—such as advanced HVAC systems, clean rooms, and energy-efficient systems—that set them apart from traditional commercial real estate. As Sacramento continues to attract more biotech firms, demand for these specialized spaces is expected to increase.

For investors, life-science real estate presents a growing opportunity in Sacramento, particularly as the industry benefits from increased government funding and rising healthcare demands. Given the unique nature of these facilities, they often command premium rents and attract stable, long-term tenants, making them an attractive investment in the commercial real estate market.

Inflation, Consumer Confidence, and Their Impact on Real Estate

Inflation remains a key factor influencing Sacramento’s commercial real estate market. Rising costs for goods, energy, and services are putting pressure on businesses, while consumers are facing the effects of higher prices. These factors could lead to reduced consumer spending, particularly in non-essential retail sectors, which could in turn impact retail tenants.

Additionally, consumer confidence has been declining, influenced by economic uncertainty and geopolitical tensions. Lower confidence can reduce both consumer spending and business investment, which can create headwinds for commercial real estate sectors that rely on strong consumer activity, like retail and office.

However, inflationary pressures may also drive demand for affordable housing and value-based retail, providing opportunities for investors focused on essential needs. Investors who strategically target sectors that provide long-term stability, such as affordable multifamily housing, essential retail, and logistics facilities, are likely to fare better in this environment.

Partnering with a Commercial Real Estate Firm in Sacramento can make all the difference when navigating the complex market trends and investment opportunities that shape the region’s real estate landscape.

Conclusion: Is Commercial Real Estate a Good Investment in Sacramento Right Now?

Sacramento’s commercial real estate market offers a mix of opportunities and challenges for investors. The multifamily and industrial sectors remain strong, driven by demand for housing and logistics, while the office and retail sectors face more uncertainty as businesses and consumers adapt to economic changes.

The recent interest rate cut has made financing more favorable for investors, but rising construction costs, labor shortages, and inflation continue to present challenges. Investors who focus on properties with strong fundamentals, such as tenant stability, essential uses, and sectors with growing demand, like life-science real estate, will likely find better opportunities in Sacramento’s evolving market.

For those looking to invest in Sacramento, prioritizing land, life-science properties, and sectors that meet essential needs—such as multifamily housing and industrial logistics—offers the best potential for long-term success. Redevelopment projects and value-add opportunities, especially in multifamily and industrial sectors, are becoming more attractive as new construction becomes more expensive. Keeping a close eye on external factors, such as inflation and consumer behavior, will help investors navigate the current landscape and make sound investment decisions.