Disruption is often a good thing, especially if it’s planned for with a strategy in place. Despite COVID, commercial real estate has been performing very well into mid 2022, with office being an exception. However, despite the rosy picture many of our industry groups are painting, I am less optimistic as we enter the fourth quarter and early 2023. However, I want to mention that this doesn’t mean it’s doomsday – it’s quite the opposite. Is commercial real estate a good investment: the following piece offers insight and analysis, including thoughts on 1031 exchange rules.

Operating a Commercial Real Estate Business

The market is too “frothy”. The opportunities for the more creative or opportunistic investor are limited because there are a lot of investors and institutional firms that are ok with accepting lower returns and/or higher risk. They believe the market will continue to increase at the same rate or are under pressure due to 1031 exchange rules.

I tend to follow my instincts based on my real-world day to day experiences operating a commercial development, brokerage, and property management business. I don’t get too caught up analyzing numbers and the large economic forecast whitepapers published by some of the larger firms. Many times they compile data and then an economist crunches those numbers to make a prediction vs. really understanding the day-to-day challenges facing the industry.

Sure, rents have been going up, cap rates going down, debt has been cheap, and equity has been prevalent. However, there comes a point when the rent tenants can pay caps out, cap rates bottom out, interest rates bottom out, and the pendulum must start to swing the other way. As the saying goes, “what goes up must come down”.

Tight Margins, Fed Interest Rate Hike and Construction Cost Issues

As a developer, I believe we are at the tipping point. This happens when the developers’ margins are too tight so projects don’t pencil at all or it’s way too risky for such a low return. We are at this point. I know multiple developers that have either recently scrapped their projects or put them on hold. They believe with the Fed interest rate increases and construction costs at all-time highs, the projects simply don’t make sense anymore.

- While nowhere near their all-time high, the Fed interest rate has steadily increased and it just increased again a few weeks ago.

- The 10-year treasury yield is also up, and Fed interest rate increases are on the agenda for the remaining Federal Open Market Committee meetings. This means that the cost of capital is higher so achieving the lenders Debt Coverage Ratio (DCR) minimum is going to require more equity.

- In addition, lenders are tightening their loan to value requirements. One local bank recently announced that it was no longer going to provide financing for home builders. I see this as a real red-flag because access to capital for developers is necessary.

- On top of this, home builders already have major drags with Fed interest rate increases and construction costs.

- Investors could be affected by the 1031 exchange rules proposed by the Biden administration

- Construction costs continue to remain high as some materials decrease while others have increased. Therefore, there hasn’t been any relief in material costs overall.

- Our contractor has seen a 30% increase in glass and other increases in materials requiring oil such as asphalt. Gas prices are driving up the cost of goods being transported long distances.

- Labor problems remain high and in short supply as well.

- The icing on the cake is that the industry is still struggling with supply chain issues. For example, the suppliers of switchgear (a major and necessary building component) are quoting at over 50 weeks.

- We haven’t seen consumers tighten the purse strings yet. But there is no doubt that inflation and the higher cost of basic goods and services are going to have an impact.

- Higher consumer prices recently boosted the annual inflation rate to its highest level in more than four decades.

- The cost of energy, which combines items like gasoline, electricity, and fuel oil, is up more than 34% from a year ago. Consumers are paying more for goods and services and not seeing the same level of increase in wages.

- Consumer confidence fell for a second consecutive month in June – its lowest point in nearly a decade. A few reasons why:

- Local and geopolitical conflicts

- General polarization of society

- Midterm elections in November

- COVID still looming like a dark cloud that impacts consumer confidence.

- Looking ahead over the next six months, consumer spending and economic growth are likely to continue to face strong headwinds according to the US Conference Board’s report.

Commercial Real Estate Analysis: Advice on Each Sector

With all that said, now the question is: What does this mean for specific commercial real estate sectors? Is commercial real estate a good investment? I answer those questions below with researched opinions of my own.

Multifamily

Given rising interest rates in the single-family market, people will likely rent longer keeping vacancy rates low and upward pressure on rental rates. As of Q1 2022, according to Moody’s Analytics, vacancy rates were at 4.7%.

- The multifamily sector will remain fairly strong

However, consumers will eventually cap out on what they can afford in rent.

- They’ll shift to cheaper, more affordable and often slightly older apartments

- Therefore, new development will start to slow down

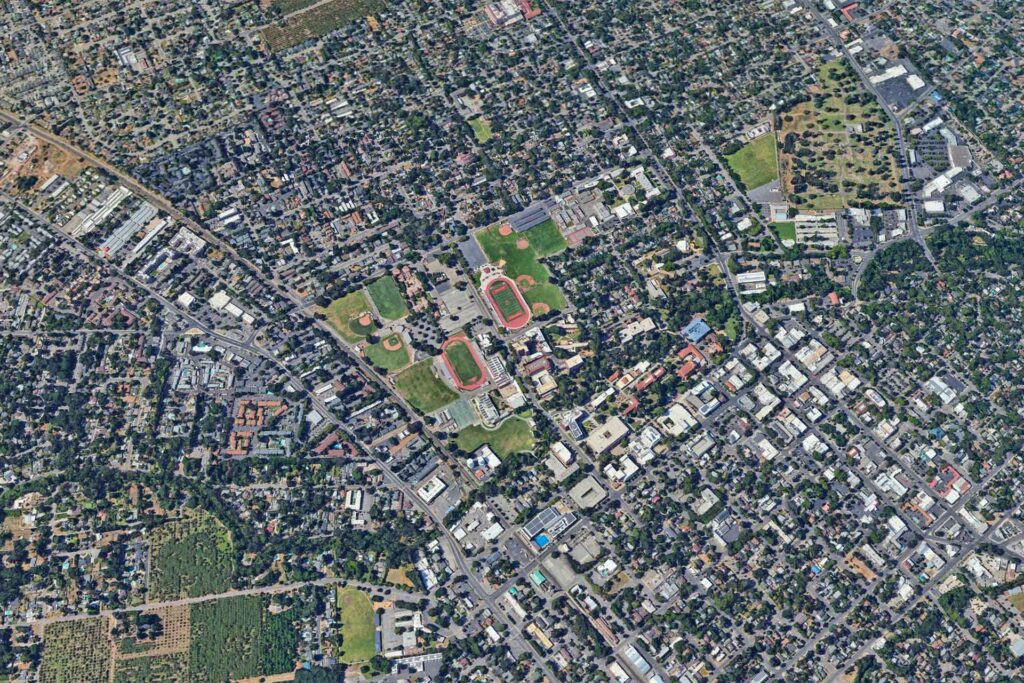

In Sacramento apartment rents have continued to climb with gains of 5.6% in the past 12 months. There continues to be a massive shortage of affordable housing.

Office

The office sector will continue to struggle as businesses are still trying to figure out the hybrid work model and the labor shortage issue. Adding to the mix, their costs of labor and operations continue to increase. Two of the keys for organizations to rethink:

- How the office will be utilized

- Amenities being providing to increase workplace efficiency and employee retention

We will continue to see reductions in the square footage of necessary office space:

- Previous standard was set as several hundred square feet per employee

- With a reduced workforce, it could reduce the need for that much space

In Sacramento annual rent growth is around 1.8% compared to the national average of 1.1% which is indicative of the challenges the office sector has faced.

Industrial

The demand for industrial space remains strong and will likely continue to remain strong for the remainder of the year. But changes might be coming for the industrial market too because:

- Consumers have started to pull back on their spending (both online and in-store)

- Home building is slowing down with Fed interest rate hikes

I would anticipate companies taking a harder look at how to increase efficiencies within their existing facilities before investing in additional space. As a result, rental rate increases will start to level off and even decline.

In Sacramento the industrial market is still hot with vacancy around 3.6% and new inventory is being absorbed faster than its completed.

Retail

Retail is a mixed bag because it really depends on the particular subset of the sector that is being analyzed. We will continue to see continued store growth and investor demand for “essential” retail uses, discount retailers, and fast food. When consumers start to feel as though they have less wealth, they naturally adjust their spend.

- This is why I have always been a fan of “essential” retail uses, discount retailers, and fast food: they do well in good times and even better in challenging economic times

- The very high-end luxury brands will continue to do well

- The brands that serve the middle class, and particularly those that haven’t adapted an omni-channel or COVID contingent model, will struggle

- We will see cap rates across the board start to increase and particularly for the larger priced assets that require most investors to secure debt

- Unanchored strip retail and shop space in general will see increased cap rates and downward pressure on rental rates as smaller business owners struggle to make a living: because of this, vacancy rates will increase

In Sacramento rental rates have increased 1.3% averaging around $22.00/sf over the past 12 months. Vacancy rates are around 5.7%.

Bottom line: Is Commercial Real Estate A Good Investment?

The upside is that as construction slows down in certain sectors and interest rates increase, we should start to see less demand for materials and labor. This will hopefully provide some relief for those developers that are building products that remain in demand. This will help them maintain a healthy margin going into the project. To be more specific, I anticipate seeing more re-development opportunities.

For multi-family units, this includes taking an older product and modernizing the units, with involvement in public-private or government backed affordable projects. This could include:

- Adaptive reuse

- Modular construction for multi-family

- Affordable housing

In addition, it could include:

- Creative office space

- Retail development

- Redevelopment for essential uses

Fast-food, medical, and senior care will remain strong. I anticipate seeing more opportunities to acquire distressed assets from investors that are either over-leveraged or have strict loan covenants that force them to sell.

Closing Thoughts: Commercial Real Estate Market Analysis

Keep an eye on the following:

- Fed interest rate hikes

- Supply chain issues

- Inflation

- Consumer confidence

- Geopolitical events

- Midterm elections

- Proposed changes to 1031 exchange rules

Maintain a lower amount of leverage, keep cash reserves on-hand, focus on essential uses and the financial strength of the tenant(s), prioritize quality locations over maximum returns, maintain strong relationships with your team (lender(s), tenant(s), broker(s), etc.), and start looking for creative opportunities.

…

We love chatting about commercial real estate, especially when it comes to Sacramento. If you are interested in learning more, sign up for our email blast or contact us!