In commercial real estate, accurately measuring a property’s square footage is paramount. This not only affects the rentable area but also the property’s valuation and the rent charged to tenants. The Building Owners and Managers Association (BOMA) has set standards to ensure consistency and accuracy in these measurements. To grasp the significance of adhering to these standards, we must first understand some foundational definitions and then delve into both the tenant’s and landlord’s perspectives.

USABLE SQUARE FOOTAGE (USF):

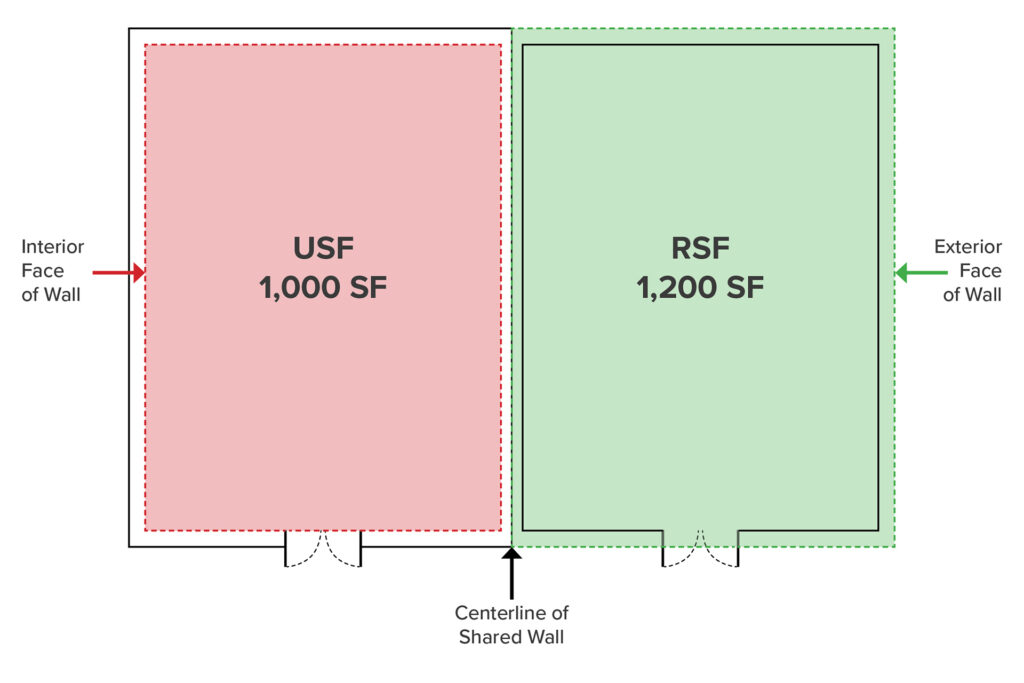

- Definition: USF refers to the physical space within a leased area that a tenant can exclusively occupy for their activities.

- Components: This includes the entire floor area of the tenant’s specific unit, from wall to wall measured to the “interior face” of the walls. It excludes areas like building mechanical rooms, lobbies, restrooms, and communal hallways.

- Usage: USF is vital for tenants as it determines the functional space available for their operations, such as office setups or product displays.

RENTABLE SQUARE FOOTAGE (RSF):

- Definition: RSF denotes the total area for which a tenant pays rent. It includes the USF and a proportional share of the building’s communal areas.

- Components: In addition to the USF, RSF encompasses shared spaces like restrooms, corridors, lobbies, communal kitchenettes, stairwells, elevator shafts, and mechanical rooms. The calculation also includes the measurement to the “exterior face” of the exterior walls and to the “centerline” of any shared or common walls.

- Load Factor: Often, the difference between RSF and USF is termed the “load factor” or “common area factor.” Especially in office leasing, this factor represents the percentage of a building’s total area that a tenant pays rent for, even if they don’t directly use it.

The load factor is calculated as: Load Factor = (RSF – USF) / USF

Usage: RSF is essential for both tenants and landlords. For landlords, it indicates the total rentable space and potential rental revenue. For tenants, it determines the comprehensive rent, inclusive of their share of the building’s communal areas.

WHY THIS DISTINCTION MATTERS

Tenants pay rent based on both RSF and USF. Therefore, understanding this distinction can significantly influence their rental expenses. Recognizing the USF allows tenants to optimize their space, ensuring they allocate sufficient room for their operations without incurring unnecessary costs. Knowledgeable tenants can negotiate favorable lease terms, such as a reduced load factor or specific RSF exclusions. In retail properties, this differentiation is especially crucial. Retailers aim to maximize their USF for customer flow, sales activities, and product displays. However, they also recognize that they pay for additional shared spaces, like parking areas and common corridors, which enhance the overall shopping experience.

FROM THE TENANT’S PERSPECTIVE

Tenants gain confidence when they know a building adheres to BOMA standards, fostering trust with the landlord and preventing future disputes. Many leases include re-measurement clauses, allowing either party to reassess the space. Tenants don’t want to overpay, nor do they want unexpected rent hikes due to under-measured spaces. By understanding RSF and USF, tenants can budget and utilize their space efficiently.

FROM THE LANDLORD’S PERSPECTIVE

For landlords, accurate measurements ensure that all rentable space is accounted for, maximizing revenue. Discrepancies can lead to time-consuming and expensive disputes. Adhering to BOMA standards can mitigate these issues. Accurate measurements also play a pivotal role in property valuation, especially when landlords seek to sell or refinance. Lenders and buyers often rely on these

metrics. For instance, if a space is presumed to be 10,000 square feet (based on the landlord’s calculations) but is actually 10,500 square feet due to professional measurements of both USF and RSF, the implications are significant:

Initial Calculation: $24.00 × 500 square feet = $12,000

Yearly Increase: Rent increases by 3% annually.

Total After 10 Years: $16,128.93

Assuming the landlord intends to sell the asset at a 5.5% capitalization (CAP) rate, the additional $12,000 translates to an added value of $240,000.

$12,000 / 5.5% (CAP) = $240,000

CONCLUSION:

Both tenants and landlords benefit from precise commercial property measurements. Tenants get value for their money and can use their space effectively. Landlords maximize revenue potential and enhance property value. Adhering to BOMA standards ensures consistency, transparency, and trust in the commercial real estate sector, making compliance indispensable for all stakeholders.